- 208.577.5501

- info@boisehunterhomes.com

- Model Homes Open Daily: 11a - 6p

ONLY SIX HOMES LEFT IN SKY MESA! Don’t miss out on these incredible homes and views! See homes here.

Your search results

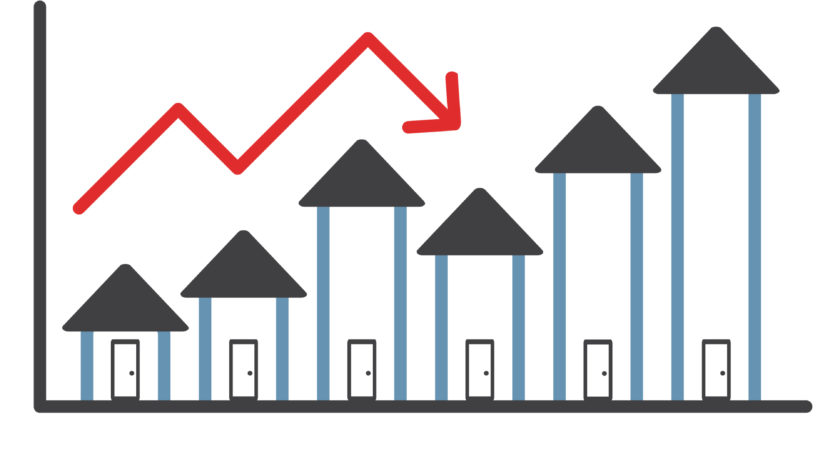

A Big Win for Home Buyers

August 21, 2019

Mortgage rates have fallen in the last week and this is a great thing for prospective home buyers. Oftentimes the jargon about rates can be overwhelming and seem unimpressive. What does a near 1-point drop in rates over the past year even mean? How does this make your home more affordable? Keep reading to see how we crunched the numbers.

The difference between mortgage rates today 3.75% and a year ago 4.59% (on a 30-year fixed) may not seem significant, but let us show you how the numbers work in your favor. On a $300,000 30-year fixed loan today versus last year you would save $210 per month in interest payments (nice), around $2,500 per year savings (super nice). And over the course of 30 years, you would save a whopping $75,600 (what?!) from a 0.84% mortgage rate drop year over year. Essentially for every 1% in mortgage rates moving you’re looking at a 30% swing in the cost of the home and right now that swing is totally in your favor.

Did we mention we have some great houses for sale?

Source: https://www.washingtonpost.com/business/2019/08/08/mortgage-rates-plunge-their-lowest-levels-months/

load more listings

Quick Links

"*" indicates required fields

Copyright © 2024 Boise Hunter Homes. Prices, plans and DCR Community Center renderings subject to change at anytime and are not guaranteed.